Ciaran Fitzgerald

Agri-food economist

Underappreciated and undervalued

Anybody attending the plethora of agricultural shows across the country this summer and, indeed, preparing for the upcoming National Ploughing Championships has a clear sense not only of the scale of Ireland’s agri-business but the depth of its impact on the rural and regional Irish economy through machinery suppliers, animal health and veterinary services, agri-business services, contracting, transport and distribution services.

Export-driven

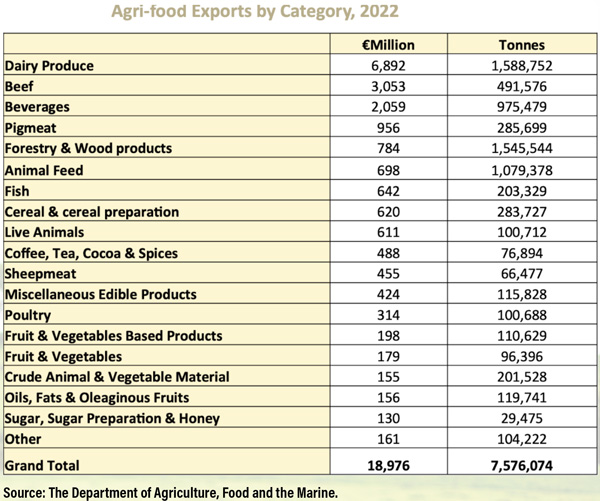

The numbers of jobs supported directly and indirectly and the scale of exports to global markets across a range of products are well illustrated by CSO figures for 2022, which show an agricultural labour force of 270,000 people, and exports of a record €18.98bn, with approximately 90 per cent of Irish beef, sheepmeat and dairy produce exported each year. The list includes more than €1bn in value from each of fresh or chilled Irish beef, natural butter, cheese and Irish whiskey.

While the financial export figures, which have almost doubled in value over the last decade, are impressive, the volume of physical exports, amounting to over 7.5m tonnes of food, drink and forestry products, best shows the ‘weight and depth’ of Irish agri-sector transactions. This starts with on-farm production, which is then transported off farm to manufacturing across more than 2,000 businesses in Ireland and, finally, is then exported and distributed to more than 180 destinations, globally. All of this demonstrates that the true essence of the economic impact of Irish food and agri-business comes from its driving of activity inside the Irish economy.

Analyses from the CSO and numerous industry studies have demonstrated the economic weight of these production and export transactions in terms of Irish economy multipliers of 2.5 for beef and 2.3 for dairy and the consumer foods sector. These figures compare impressively well with an average output multiplier of 1.4 for the rest of the economy and 1.2 for foreign-owned firms.

The economic multiplier effect

The financial validation of this Irish economy impact is further highlighted in the Department of Enterprise, Trade and Employment (DETE) Annual Survey of Economic Impact which estimates spending by the agri-food sector on raw materials, wages, salaries and services amounted to just under €20bn in 2022 out of a total of €73bn by Irish-based industry.

The Irish agri-food economic multiplier impact is even more specifically demonstrated by the fact that the Irish economy was the source of 80 per cent of expenditure for Irish food and drink companies, with only 10 per cent of total expenditure by multinational companies linked back into the local Irish economy.

Contradictory agri-economic profile

Yet, a quick Google search of the economic profile of the Irish economy gives a GDP contribution of 44 per cent for manufacturing and 52 per cent for services, with primary agriculture listed as contributing only 1.2 per cent. Think of that 1.2 per cent of GDP, in terms of the 7.5m tonnes of agriculture-related business exports annually from Ireland, and one realises that this is what can best be described as car-bumper-sticker economics. It is, quite frankly, nonsensical.

As a summary of the value and profile of Ireland’s economic output and activity, this GDP figure is clearly a work of fiction, reflecting how, as modern globalised/offshored economies and metrics of economic activities have evolved, it has become more and more difficult to attribute global company revenues and financial flows to specific local and national economic activity.

Notwithstanding this statistical conundrum, I would suggest that a better understanding of what’s real, and what is passing through our Irish economy (or 'just resting in our accounts' as Father Ted put it), is surely of crucial importance if we are to sustain and develop all the key drivers of Irish economic activity.

The best mix of economic drivers

In fairness, even excluding the €200bn of flow-through money that has a zero Irish economic footprint, the impact of multinational companies is substantial, yielding almost €25bn in corporation tax in recent years and supporting 150,000 jobs across the economy. These tax and employment figures alone confirm the benefits of a vibrant foreign-direct-investment (FDI) sector to the Irish economy. Ireland, as was demonstrated most recently in the Great Recession of 2008, needs a number of high-performing economic sectors to sustain our economy and society, and there is no conflict between supporting and sustaining the Irish agri-food sector and, at the same time, supporting and sustaining the multinational sector. In this diverse economic approach, we need to fully acknowledge the almost €20bn of Irish economic expenditure, combined with the huge regional and rural employment, that is being underpinned by Ireland’s agri-food sector. With an economic multiplier effect of 2.0, our agri-food industry shows how a fully integrated sector of the Irish economy supports almost 300,000 jobs across the country. Its critical importance must be fully understood and appreciated when the true profile and performance of the Irish economy is being assessed and its sustainable future is being planned.

In conclusion, we can say categorically that emissions challenges affecting FDI investment will be very carefully managed, acknowledging its key role in our economy. Curtailing another key part of the Irish economy, through effective 'quota-isation' of Irish dairy and beef numbers to manage sectoral emissions targets, rather than supporting MACC curve implementation of agricultural emissions reductions, is not only bad science, but also bad economics.